I also tried working with using the Heiken Ashi but pinpointing the specific candle entries was very challenging. So I went back to the regular bars.

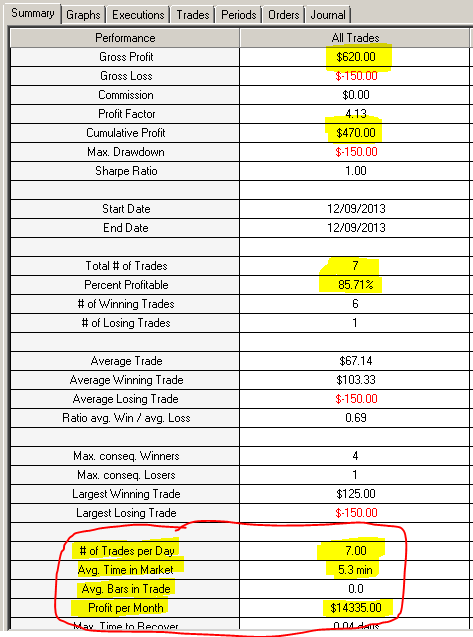

Interestingly the results were

great !

The trade results using multiple contracts without trailing stops during US session was

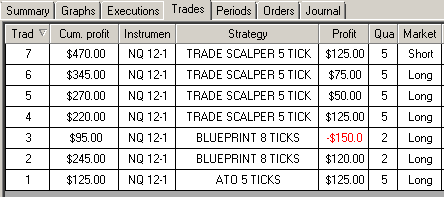

- $470. including

- $150.00 loss and

- 7 trades

- 3 % risk management - $225. based on a $7,500 account

- Trade scalper method was used after the first loss until end of session

- ATO, blueprint, scalp methods used

- X5 was tried but levels were not respected at all compared to ES

The trade summary was also something else. That would definitely be a wonderful goal even at a 50% success rate, wouldn't you say. The key thing is that margin per contract is at 500, so while I doubt I would trade live at 5 x 500 margin on my small account, the potential even at 2 or 3 seems doable.

Well, keep on practicing !!!

No comments:

Post a Comment