https://www.cnn.com/2018/01/26/politics/air-force-one-refrigerator-contract-boeing/index.html

"Although serviced on a regular basis, reliability has decreased with failures increasing, especially in hot/humid environments. The units are unable to effectively support mission requirements for food storage," she said.

Translation .. old equipment needs replacing ..... but hey ... gotta keep those Diet Cokes cold ...

Saturday, January 27, 2018

Friday, January 26, 2018

Rewind: Enron - The Smartest Guys In The Room

Was watching this and when Enron was ranked by Fortune as to most admirer .... Look who is ranked as the least admired.

Corruption is simply amazing ....

Focus on not becoming corrupted all ....

Corruption is simply amazing ....

Focus on not becoming corrupted all ....

Nasdaq, Dow, S&P 500 Close at Record Highs as Bullish Earnings Extend Bull Run

Nasdaq, Dow, S&P 500 Close at Record Highs as Bullish Earnings Extend Bull Run

https://www.investing.com/news/stock-market-news/nasdaq-dow-sp-500-close-at-alltime-highs-as-bullish-earnings-continue-1158521

Thursday, January 25, 2018

CL - Aanalysis - End of Day - 1-25-18 - $65.25 - Full Elliott Wave Cycles with Fibonacci Targets

12.35 PM

$65.35

Complete Elliott Wave 1-5 and A-B-C cycles completed.

Ironically, when we look back at the original first post,

Analysis - A+

Execution - C-

Obeyed the rules to stay out but never got back in. I need to work on believing more in myself and my analysis ...

We Design Gravy-Trains

"Choose Your Speed"

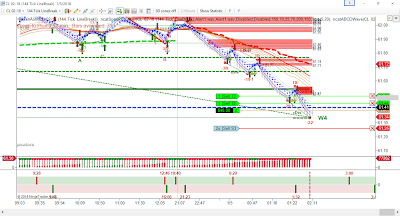

CL Analysis 12 AM 1-25-18 ; $66.16

Well here we went again .. an early morning analysis as to a potential Long target ..

By 6 AM, The market eventually moves to TAP the $66.55 projected level, overruns by about 12 ticks and the drops like a brick to current $66.22 levels.

Where was I .. caught up in another nice chop, losing $200 on one contract

Demoralized, I didn't enter, but .. the analysis was totally on point ...

ARRRRRGGGHH !!!!!

Currently looking at a developing A-B-C Elliott Wave short with an expected retrace back upi to retest $66.55 again, which, if holds,

looking at a follow-through back down SHORT to $66.00.

Basis of which is chart below ....

7.30 AM - $66.28

Final formation of A-B-C WAVE SHORT

10.15 AM

Eventual Elliott Wave Flows

A-B-C

1-2-3-4-5

Possible restart of 1-5 or push to larger Wave-5 with a break of Long 1-5.

--

We Design Gravy-Trains

"Choose Your Speed"

Wednesday, January 24, 2018

Screenshot 2018-01-24 at 2.45.20 PM

Oil's marvelous run today as it hurdles each Fib level one by one. Zones drawn about three to four days ago. Give myself an A+ for projective analysis, but an F for execution since I wasn't in any trades and had major losses when I got chopped up yesterday and stayed out after that.

Just gotta love those Fib levels !!!

Just gotta love those Fib levels !!!

Wednesday, January 10, 2018

Fwd: CL Analysis - 1-10-2018 5m 15m 60m 63-37

Original early analysis. Current price did not fully follow it and is now heading long, playing with $63.55

Monday, January 8, 2018

CL Analysis - 1-8-18 - $62.06 - Fibonacci Targets HIT and Rebound Short - " Just gotta luv Fibonacci levels ! "

So we left the session near the end of the day with a stagnation near $62.03.

At the resumption into the Globex near 3.35 PM PST.

hit ALL Fib levels based on analyses from weeks ago.

Will be working on a respective trade logging system to document what we've learned from these past weeks. Stay tuned.

Just gotta luv Fibonacci levels ! :)

--

We Design Gravy-Trains

"Choose Your Speed"

Friday, January 5, 2018

"Today Was A Good Day" ~ Ice Cube .... CL 1-5-2018 $61.45 - Morning Tally : $680 less $64 commissions.

Well today was.. a good day.

It validated a lot of things we do.

I hope to share it with those closest to me.

If they don't want to listen, then I also share to whoever reads this blog ... ;)

But once the combo clicks .. enjoy the knowledge while it lasts ..

(I won't Always be here .. ;))

Time's a tickin' .....

What today entailed was initial analysis done near 12AM just to identify potential levels.

Once we watched the market move, then we adjusted accordingly.

This was based on old-school methods what's known as "Top-Down Approach".

Simply means you look at the same markets from multiple timeframes of TIME.

Higher time frame for base perspective, and then DRILL down to the smaller / lessr timeframe.

3 initial time-frames.

Today we used 5m, 15m and 60m (m=minutes) which is what this chart represents.

https://tvc-invdn-com.akamaized.net/data/tvc_e4743755b7b500ab7bbc07e86803b790.png

There is analysis done on ALL three time-frames. Each supports and challenges the other ....

While apparently democratic, the higher time frame normally dominates.

The lesser time frames often cater to greater personal gratification.

Utilizing 3, simultaneously allows us to balance our thought process when markets appear to move strongly on one level, then when checked on the "higher" level, it is a relatively smaller move.

Great for directional understanding.

All levels are based on simple principles of

and targeted projections based on Fibonacci and Elliott Wave levels.

Share your desired trading knowledge, or need,

and we will aim to supply knowledge and info accordingly.

Trade again soon ..... ;)

YkIL !

Check earlier coverage and updates :

http://tradingwiththetrini.blogspot.com/2018/01/cl-analysis-1518-6170-5m.html

TODAY's Daily Tally :

Morning Tally : $680 less $64 commissions.

It validated a lot of things we do.

I hope to share it with those closest to me.

If they don't want to listen, then I also share to whoever reads this blog ... ;)

But once the combo clicks .. enjoy the knowledge while it lasts ..

(I won't Always be here .. ;))

Time's a tickin' .....

What today entailed was initial analysis done near 12AM just to identify potential levels.

Once we watched the market move, then we adjusted accordingly.

This was based on old-school methods what's known as "Top-Down Approach".

Simply means you look at the same markets from multiple timeframes of TIME.

Higher time frame for base perspective, and then DRILL down to the smaller / lessr timeframe.

3 initial time-frames.

Today we used 5m, 15m and 60m (m=minutes) which is what this chart represents.

https://tvc-invdn-com.akamaized.net/data/tvc_e4743755b7b500ab7bbc07e86803b790.png

There is analysis done on ALL three time-frames. Each supports and challenges the other ....

While apparently democratic, the higher time frame normally dominates.

The lesser time frames often cater to greater personal gratification.

Utilizing 3, simultaneously allows us to balance our thought process when markets appear to move strongly on one level, then when checked on the "higher" level, it is a relatively smaller move.

Great for directional understanding.

All levels are based on simple principles of

- Fibonacci

- Elliott Waves

- Cash-Cow Fib Bounces

and targeted projections based on Fibonacci and Elliott Wave levels.

Share your desired trading knowledge, or need,

and we will aim to supply knowledge and info accordingly.

Trade again soon ..... ;)

YkIL !

Check earlier coverage and updates :

http://tradingwiththetrini.blogspot.com/2018/01/cl-analysis-1518-6170-5m.html

TODAY's Daily Tally :

Morning Tally : $680 less $64 commissions.

CL Analysis - 1/5/18 - $61.70 5m

https://invst.ly/69drf

So, the overall push right now since 12.00 AM has been to the short side.

Currently trailing back up off the x.35 level.

Have not yet been stopped out but at 2.30 am volatility has waned and we're just floating at 61.46

Overall it's been relatively good analysis and targets almost to the tick.

I will be aiming to get more into potential trends with less counter-trend.

Time warps are being used in tandem with the oscillator and activators.

Template Used: 20171219_CC_Mobile_1

Stopped out near 3.00 AM - Stagnant at 61.42

Morning Tally : $240 less commissions.

Took a couple more trades while market was consolidated. Kicked back off near 5.30 AM ....

Morning Tally : $490 less commissions.

Took a couple other quick scalp trades based on Fibonacci crossover levels ... Targets 1x3, 1x5, 1x7 R13.

Worked out ok and market appearing to be swinging more to longs now.

Morning Tally : $680 less $64 commissions.

Thursday, January 4, 2018

Oil Hits 3yr High - 1-4-2018 - $61.80 Just Before The Open

Currently in Elliot Wave 4th wave retracement .. longer term 5th wave expected in January past current high

CL Analysis - 1-4-2018, $62.10, 12 AM PST

Nearing Elliott Wave Completion with

possible last thrust up to $62.55 - $62.85

Consolidate $62.09 - $62.41

before A-B-C Retracement

possible last thrust up to $62.55 - $62.85

Consolidate $62.09 - $62.41

before A-B-C Retracement

--

We Design Gravy-Trains

"Choose Your Speed"

Wednesday, January 3, 2018

CL Analysis - 1-3-2018 $60.87 - 4.30 AM PST

Sent: Wednesday, January 3, 2018 4:41 AM

Subject: RE: CL Analysis - 1-3-2018 $60.87

Update. 4.30 AM PST

Sent: Wednesday, January 03, 2018 12:07 AM

Subject: CL Analysis - 1-3-2018 $60.33

CL Analysis - 1-3-2018 $60.33

Been using Investing.com's platform for some analysis. Their tools ae great.

Also been checking out Tradingview as well.

Still looking for that move to short levels.

Sent: Wednesday, January 3, 2018 12:06 AM

Subject: CL Analysis - 1-3-2018 $60.33

Subject: CL Analysis - 1-3-2018 $60.33

Subscribe to:

Comments (Atom)