https://invst.ly/69drf

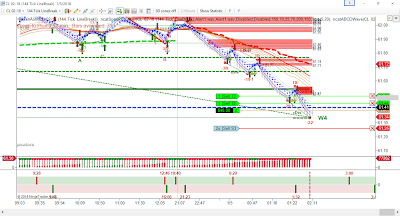

So, the overall push right now since 12.00 AM has been to the short side.

Currently trailing back up off the x.35 level.

Have not yet been stopped out but at 2.30 am volatility has waned and we're just floating at 61.46

Overall it's been relatively good analysis and targets almost to the tick.

I will be aiming to get more into potential trends with less counter-trend.

Time warps are being used in tandem with the oscillator and activators.

Template Used: 20171219_CC_Mobile_1

Stopped out near 3.00 AM - Stagnant at 61.42

Morning Tally : $240 less commissions.

Took a couple more trades while market was consolidated. Kicked back off near 5.30 AM ....

Morning Tally : $490 less commissions.

Took a couple other quick scalp trades based on Fibonacci crossover levels ... Targets 1x3, 1x5, 1x7 R13.

Worked out ok and market appearing to be swinging more to longs now.

Morning Tally : $680 less $64 commissions.

Target $61.49 HIT at 1.20 AM PST.

ReplyDelete1x3, 1x5, scalp taken - 72.00

It never rebounded to the 8-tick scalp as initially intended and had to wait a while for it to consolidate around the .49 level. It seems likely to also be aiming for a x.35 test as well.

I'm looking at letting the last contract ride past the 8-tick goal to see how far and fast it may get to the GMMA or the VWAP.

5m chart with targets may be seen here - https://invst.ly/69dfk

Looking for longs at break above 61.56 and continued short to test 35 if break 61.43 to the down-side.

Happy trading ! ;)

x.35 tested and HIT at 1.50 AM PST.

ReplyDeleteTook rebound looking for the long back to structure at 61.49

Structure @ x.49 HIT, trailing to possible 61.55 .. but looks like trailing stop may soon be hit at 61.43

ReplyDelete